In practice, building a volatility surface is quite challenging. Often only a few points are available to define the entire surface and gap-filling techniques are needed to get the full market’s view of the underlying asset. Current approaches are based on assumptions about the shapes of surfaces, and therefore only good while those assumptions hold. Second, generating surfaces is quite manual with practitioners having to hand-tune surfaces slice-by-slice and patching them together to get a good fit. This is particularly difficult when some of the terms and strikes are infrequently traded and the current best estimate of a tradable price is very uncertain.

But it doesn’t have to be this way.

Riskfuel has developed a technology to automatically complete volatility surfaces for even the most illiquid assets. The technology is purely data-driven and makes no assumptions about the process driving the underlying asset, nor about the shape of the surface. Improbable parallel shifted volatility surfaces can finally be relegated to the history books.

How Does It Work?

Riskfuel uses a type of deep neural network called a variational autoencoder to learn the space of all possible volatility surfaces for a particular asset class. Once trained, a variational autoencoder provides a fast, robust, and interpretable method that can complete volatility surfaces from partial information in real time.

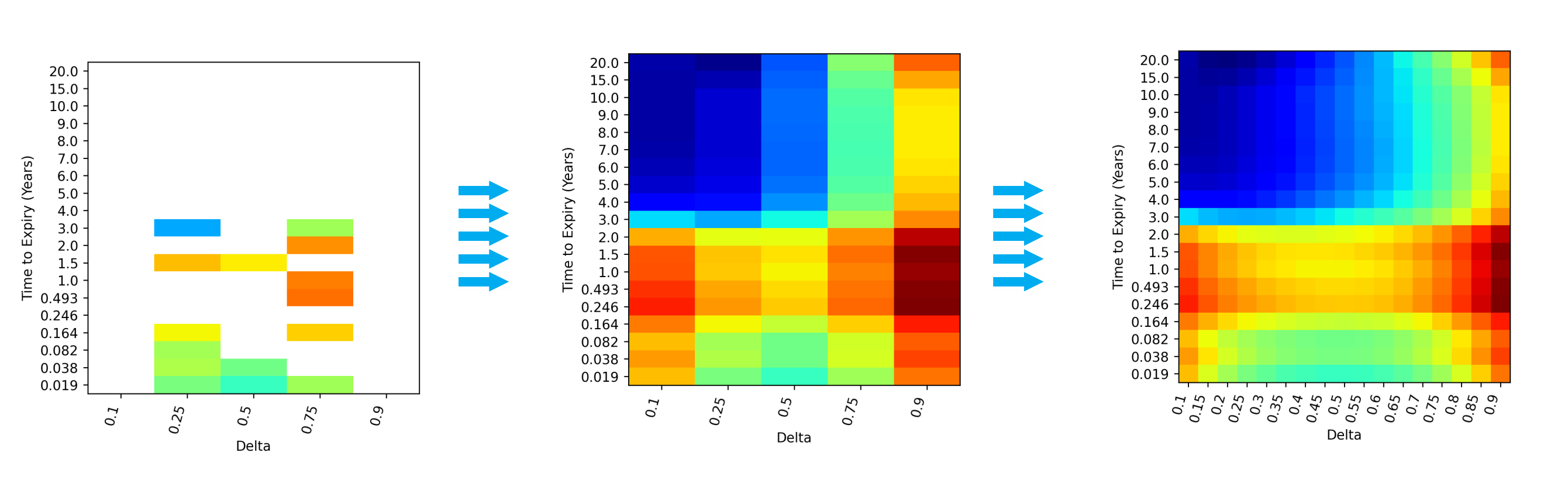

The following figures show the progression of a partially observed heatmap, to the completed heatmap, to the finely-interpolated heatmap constructed using a trained variational autoencoder.

Riskfuel

1,000,000x