The trade-off between model performance and accuracy results in unsatisfactory compromises. Use cases like XVA calculations are often best modelled as nested Monte Carlo simulations which are computationally expensive. In such cases, two options are available: a) run a limited number of simulation paths, or b) craft a crude approximation. Unfortunately, both options sacrifice accuracy and increase numerical noise.

But it doesn’t have to be this way.

With Riskfuel Model Acceleration, you can maintain high accuracy alongside high speed without breaking the bank. This means that you can develop new models and instruments that would have been impossible before today. Now you can focus on the accuracy of your models and Riskfuel will take care of runtime performance and compute costs.

A recent case study with Microsoft found the Riskfuel model performed 20 million times faster than the original target model while maintaining excellent accuracy.

How are Riskfuel Models so Fast?

Riskfuel models use a deep neural network (DNN) to learn an interpolation between millions of data points. These data points are generated by repeatedly running the target model on different input combinations covering the domain of approximation. This strategy of learning the relationship between inputs and outputs makes it extremely fast. Any financial model, despite its inherent complexity, can be trained and accelerated.

Training the DNN transforms the target model into an analytic formula. The weights and biases of the DNN are simply the coefficients of the terms in the formula. Some benefits of an analytic formula include predictable runtimes and deterministic outputs.

Riskfuel models benefit from Adjoint Algorithmic Differentiation (AAD) which is a by-product of the backpropagation algorithm used to train the DNN. AAD delivers all of your first-order greeks efficiently (no bump-and-reval necessary).

Riskfuel frees you to develop more sophisticated financial models. Focus on model richness and correctness, and let us worry about runtime performance.

What about Model Accuracy?

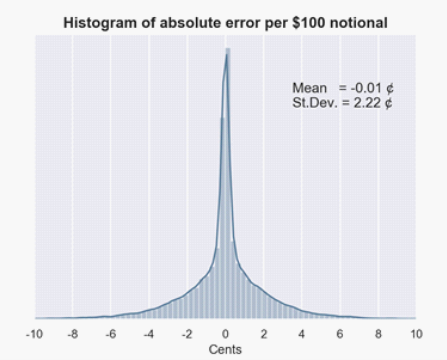

Riskfuel model accuracy depends on the data used to train it. To achieve high levels of accuracy, we dial up both the amount of training data and its quality. Since training only needs to be performed once, we generate the training data with higher level of accuracy than is typically used in production. During validation, we compare the Riskfuel model outputs against the target model for inputs across the entire domain of approximation. This allows us to ensure that the Riskfuel model performs well in all market conditions.

Try Out Our Demo Pricer

Riskfuel

1,000,000x